Each year, we issue a property assessment notice to owners of property in New Brunswick.

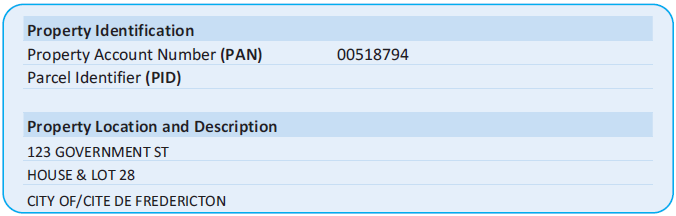

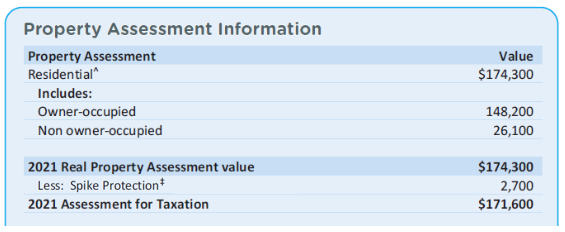

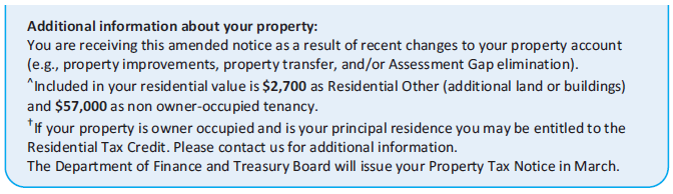

The notice contains important information about your property value and should be reviewed carefully. Advise us immediately if you disagree with any of the information on your notice, as follows:

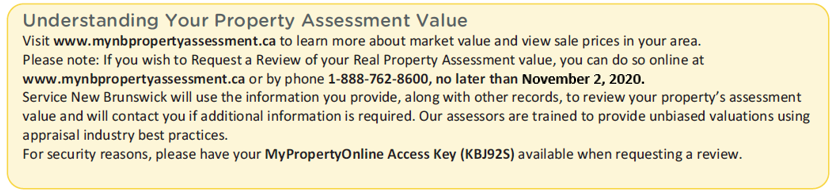

- Request for Review of your assessed value

- Change your mailing address

- Change other profile or property information

- Request a copy of your notice

Get a quick view of the notice here